VAT REFUND Services in Dubai, UAE Fast, Accurate & Compliant

A presentation at VAT Reclaim Services in Dubai – Fast, Accurate & Compliant in December 2025 in by Shuraa Tax

VAT REFUND Services in Dubai, UAE Fast, Accurate & Compliant

Value Added Tax (VAT) compliance in the UAE is crucial, but so is ensuring you don’t overpay. If your business has incurred more VAT on purchases and expenses (Input Tax) than it has collected on sales (Output Tax), you may be entitled to a refund from the Federal Tax Authority (FTA). At Shuraa Tax, we are your team of knowledgeable and qualified accountants, auditors, and tax advisors, dedicated to streamlining the complex VAT refund in Dubai. Our goal is to ensure your business recovers its maximum eligible VAT refund swiftly, accurately, and in full compliance with UAE VAT Law.

What is VAT Refund in Dubai? Vat Refund or VAT Reclaim, is the process where a registered business or an eligible entity applies to the Federal Tax Authority (FTA) to recover the excess input tax they have paid. In the UAE VAT system, a business acts as a collector, remitting the difference between the VAT it charges customers (Output Tax) and the VAT it pays on its business expenses (Input Tax). A reclaim situation typically arises when: Input Tax > Output Tax: Your company’s recoverable input VAT exceeds the output VAT collected for a given tax period. Zero-Rated Supplies: Businesses primarily dealing with zerorated supplies (like exports or certain international services) often have high input tax but zero output tax, leading to a refundable amount. Foreign Business Expenses: Non-resident businesses incurring VAT on expenses in the UAE are eligible under specific conditions.

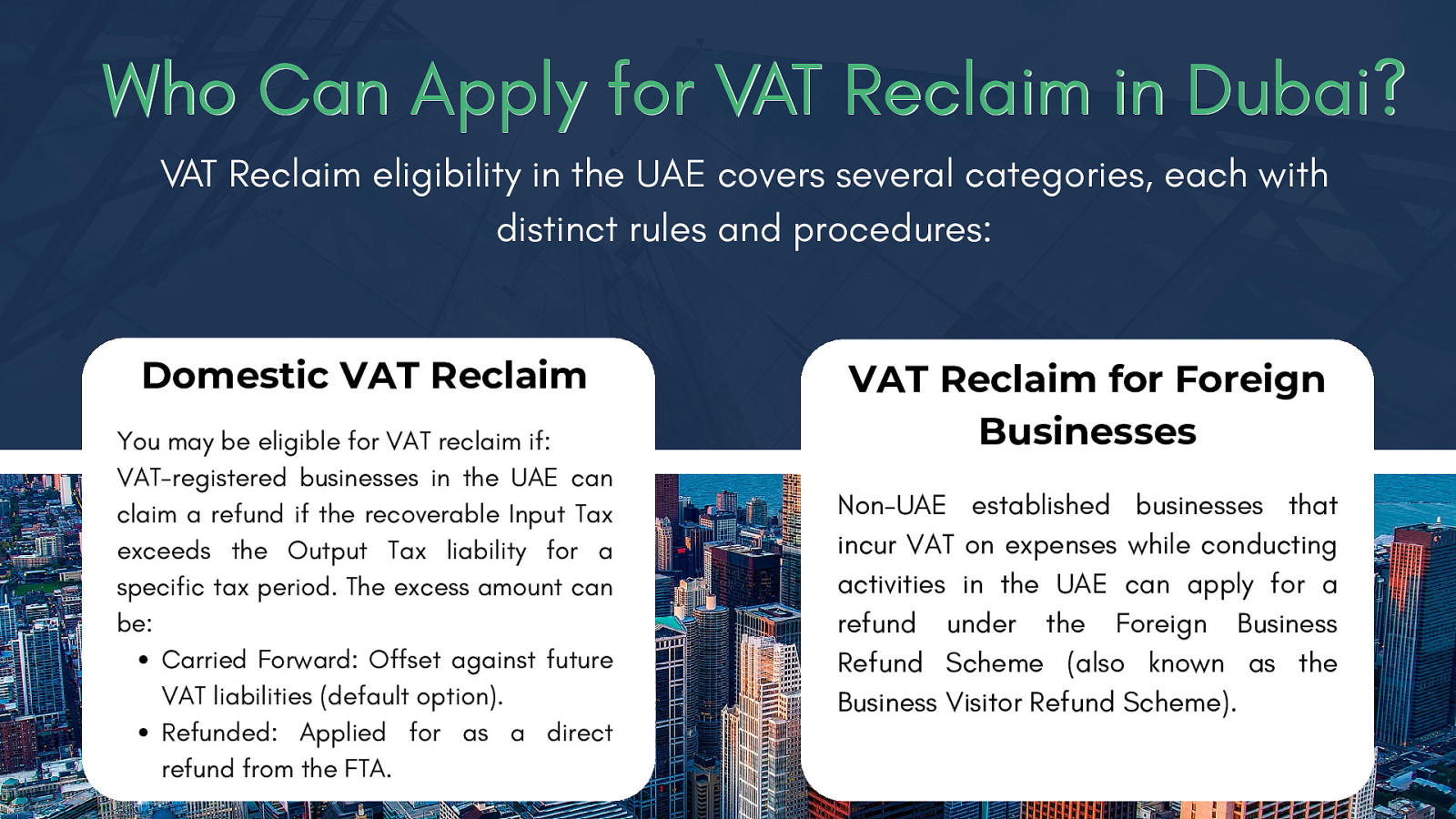

Who Can Apply for VAT Reclaim in Dubai? VAT Reclaim eligibility in the UAE covers several categories, each with distinct rules and procedures: Domestic VAT Reclaim You may be eligible for VAT reclaim if: VAT-registered businesses in the UAE can claim a refund if the recoverable Input Tax exceeds the Output Tax liability for a specific tax period. The excess amount can be: Carried Forward: Offset against future VAT liabilities (default option). Refunded: Applied for as a direct refund from the FTA. VAT Reclaim for Foreign Businesses Non-UAE established businesses that incur VAT on expenses while conducting activities in the UAE can apply for a refund under the Foreign Business Refund Scheme (also known as the Business Visitor Refund Scheme).

ELIGIBILITY REQUIREMENTS: The business must not have a place of establishment or fixed establishment in the UAE. It must not be a taxable person registered for VAT in the UAE. It must be registered as a business with a competent authority in its home country. The refund is only available if the applicant’s country of establishment reciprocates this right to UAE businesses (a list of eligible countries is maintained by the FTA). The minimum amount of VAT to be claimed must be AED 2,000. The claim period is typically one calendar year (12 months). Eligible Expenses for Foreign Businesses commonly include costs related to trade exhibitions, conferences, and other specific business activities.

WHAT IS VAT REFUND/RECLAIM Services in Dubai, UAE VAT refund services in Dubai help businesses recover the Value Added Tax they have paid on eligible goods, services, imports, or business expenses. Instead of letting excess VAT sit unused or carrying it forward, companies can apply for a refund through the Federal Tax Authority (FTA). These services include reviewing your VAT returns, checking invoices and documentation, identifying refundable amounts, preparing the refund application, and handling any clarifications requested by the FTA as part of the VAT Refund in Dubai procedure.

VAT Refund Services in Dubai AT SHURAA TAX Our VAT reclaim services help businesses simplify their VAT Refund in Dubai by ensuring accuracy, compliance, and faster approval.

WHY CHOOSE SHURAA TAX for Your VAT Refund? Choosing the right tax partner is the key to an efficient and successful VAT recovery.

CONTACT US Phone +(971) 44081900 Email info@shuraatax.com Website shuraatax.com