Cap Table & Term Sheets Learning Session July 2020 Boris Mann 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

A presentation at Cap Table & Term Sheets Learning Session (Venture Scouts) in July 2020 in by Boris Mann

Cap Table & Term Sheets Learning Session July 2020 Boris Mann 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

About • Founded the first startup accelerator in Canada, Bootup Labs, back in 2007, led to Startup Visa • Full Stack, a small seed fund for 2 years • Open Angel, a Vancouver-centric angel group • Common Docs at NACO • Advisor, #ehlist member, supporter of Canadian founders & funders • Currently: Co-founder of Fission, a dev tools company https://fission.codes 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

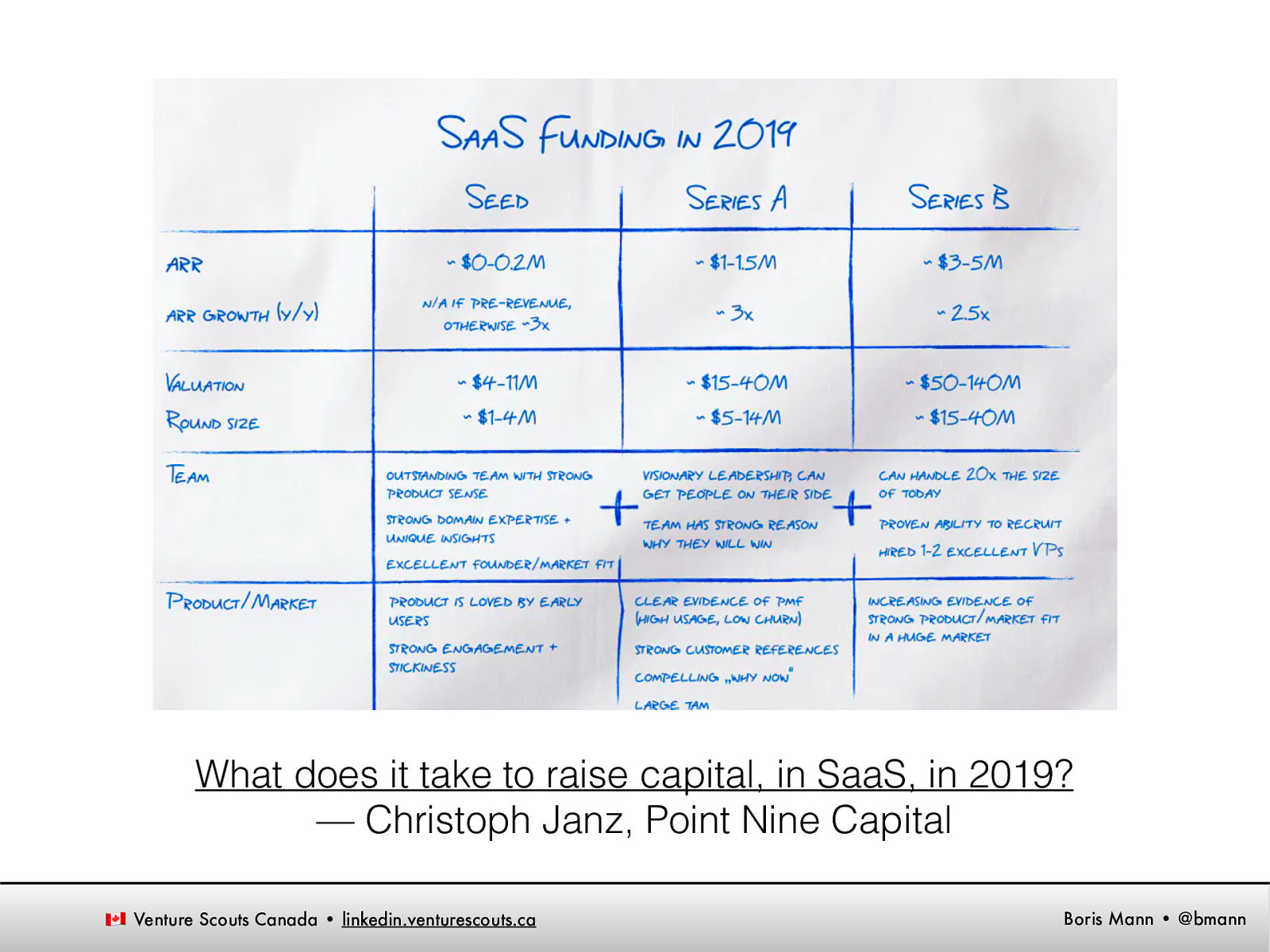

What does it take to raise capital, in SaaS, in 2019? — Christoph Janz, Point Nine Capital 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Early Stage Funding • Pre-Seed: < $500K • • Seed: > $500K to $2+ M • • SAFE (this stage doesn’t really exist in Canada, maybe call it F&F) SAFE, Convertible Note, Pref Shares CVCA docs Series A: $4M++ • Preferred Shares 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

What Investors Want • Investment Deck • • Use of Proceeds (aka Budget for 12 months) • • Hiring plan, sales & marketing “hypotheses” User Model • • Team / Market / Solution (+ Proprietary Tech or Distribution) Bottom up growth model Cap Table • Including scenario for next round 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

What is a cap table? • Aka “capitalization table” • Record of all the major shareholders of a company, percentage ownership, and what people paid for various shares over time • Employee share options are documented here as well 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Love your Cap Table • Equity is like sh*t – keep it piled in one place and it stinks, spread it around and good things grow • Reward advisors, early employees • Use your cap table to plan where you need to get to in terms of team, traction & timing • 20% max dilution at each stage 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

I was told there would be no math… • • $300K Seed 1 Round (Common Equity) • $25K / month burn x 12 months (or 6 months at $40K) • 25% dilution target == $900K Pre / $1.2M post $800K Seed 2 Round (Convertible Note) • • $60K / month burn x 12 months $1.5M Series A (Pref Shares) • $120K / month burn x 12 months • 25% dilution target == 7.7M pre / $9.2M post 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Osler • I’ve worked with Justin (and Mark) for a long time, across 2 or 3 different firms • Shannon has been working with me at Fission for the past year 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Raising from Friends and Family • Getting even one investor that is not a friend or family can give you someone to negotiate with more fairly • For small investments (and for employee shares), consider a voting trust 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

How do you pick cap for a SAFE? • Rule of thumb: your cap is the FLOOR of what you want to raise your next round at • E.g. if you want to raise $2M in your next round, 20% dilution, then you would raise at a FLOOR of $8M pre • So: current SAFE would be $8M post cap, 20% discount 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Founder Questions 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• Safes, cap tables, corporate structure for investment in Canada vs international investors 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• Considerations when raising minimum necessary for ~12 months runway for founders • Pay founders. What do you need? $60-75KCAD annual • Make a budget / use of proceeds and have investors work on it with you • ~$40K/month burn comes together pretty quickly, $500KCAD for 12 months 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• Discuss pros/cons of stacking addition SAFE rounds rather than doing a priced round subsequent to a SAFE assuming the round is >$1M and thus enough capital at risk and to pay for lawyers to negotiate what are typically pretty standard shareholder docs. 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• Term Sheets - how to balance company ‘requirements’ with investor requirements 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• The important and value of modelling out following rounds of investment as a guide to thinking and negotiating in the current round? • Yes! Your next round, and what milestones you need to hit to enable you to raise that round, and what your budget and timeline is to make that, are all something you need to consider 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• Post Money Valuation Caps - how best to set them. 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• How should an angel writing the first cheque to a startup think about? • Any readily available sources on deal data for early-stage investments? 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• I want to learn more about SAFE and how does a Cap Table look like when we raise based on SAFE ? • Raised investment from Family and Friends in different entity earlier. Want to reflect same on the Cap Table of new entity (basis current valuation less discount %). How should we put it on the Cap Table when we go to VC now? What is the tax implication on us (and investor) if they are on the CCPSCompulsory Convertible preference stock (or SAFE) basis? 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• Specifically interested in post-money SAFE’s as we’re looking at doing a round with them and haven’t used them before. Relatives merits for Co/In if next round is convertible vs priced? 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• SAFEs and priced rounds, road to series Eh 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

•

• How to setup SAFEs? • How to explain SAFEs to others (i.e. friends & families)? • What shoulder founders be most wary of? 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

• •

• What if a term sheet for a pre round insists on resetting reverse vesting for founders? 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Tools • Captable.IO https://captable.io • Captable Convertible Note Demos https://captable.io/ company/8/convertible-notes • Founded https://founded.co • Join us July 22nd for an interview with Founded, and demo of the platform 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Cap Table Spreadsheets • Simplified Company Formation • Multiple round “Ed Levinson” • Get the templates templates.venturescouts.ca 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Venture Scouts • There are no formal scout programs in Canada • • Build the next generation of investors and founders — education, diversity & inclusion, geographic diversity • • Make a template, solve the legal issues Founders investing in founders, learning more about investing that helps their own company, go on to make more angel investments Gathering interest, debating about a micro fund • $2M = 200 $10K investments, 50 scouts x 4 investments • Join the LinkedIn Group http://linkedin.venturescouts.ca 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Thank you! Boris Mann @bmann 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Pre Money SAFE • Late 2013 https://www.ycombinator.com/ documents • “Our first safe was a “pre-money” safe, because at the time of its introduction, startups were raising smaller amounts of money in advance of raising a priced round of financing (typically, a Series A Preferred Stock round). The safe was a simple and fast way to get that first money into the company, and the concept was that holders of safes were merely early investors in that future priced round.” 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Post Money SAFE • Sept 2018 https://www.ycombinator.com/documents • “But early stage fundraising evolved in the years following the introduction of the original safe, and now startups are raising much larger amounts of money as a first “seed” round of financing. While safes are being used for these seed rounds, these rounds are really better considered as wholly separate financings, rather than “bridges” into later priced rounds. • So our updated safes are “post-money” safes. By “post-money,” we mean that safe holder ownership is measured after (post) all the safe money is accounted for which is its own round now - but still before (pre) the new money in the priced round that converts and dilutes the safes (usually the Series A, but sometimes Series Seed). The post-money safe has what we think is a huge advantage for both founders and investors - the ability to calculate immediately and precisely how much ownership of the company has been sold. It’s critically important for founders to understand how much dilution is caused by each safe they sell, just as it is fair for investors to know how much ownership of the company they have purchased.” 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

Liquidation Pref Example • 50% of a company for $5M, for $10M post money • Sells for $20M • Pref shares get $5M out • then 1x of $5M (for $10M) • Remaining is $10M, of which pref shares get 50%, or $5M ($15M total) 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann

How do I split equity with cofounders? • http://foundrs.com/ is an interesting tool to walk through • Also: Reverse vesting for founders • Founders shares are granted immediately, reverse vesting clauses in the Shareholders Agreement describe how founders keep / give back those shares over time • vs. when your company is valued, you give out options, which are granted (vest) over time 🇨🇦 Venture Scouts Canada • linkedin.venturescouts.ca Boris Mann • @bmann